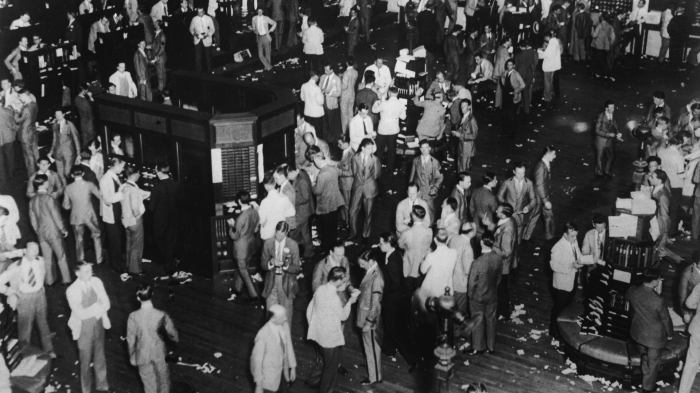

What is the nickname of the market crash that triggered the Great Depression? The Black Tuesday Crash, a pivotal event in financial history, holds the infamous title. On October 29, 1929, the U.S. stock market plummeted, marking the beginning of a prolonged economic downturn that would shape the global landscape for decades to come.

This catastrophic event did not occur in isolation. A confluence of factors, including rampant speculation, overconfidence, and inadequate regulation, created a perfect storm that led to the Black Tuesday Crash. The consequences were far-reaching, triggering a chain reaction that plunged the world into the Great Depression.

Black Tuesday Crash

The Black Tuesday Crash, which occurred on October 29, 1929, marked the beginning of the Great Depression, the worst economic downturn in modern history. The crash was the culmination of a series of events that had been building up over the previous decade.

Events Leading Up to the Crash

The 1920s was a period of great economic growth and prosperity in the United States. The stock market boomed, and many people made fortunes on paper. However, the economy was not as strong as it appeared. The Federal Reserve had been raising interest rates in an attempt to curb speculation, and the stock market was becoming increasingly overvalued.

Timeline of the Crash, What is the nickname of the market crash that triggered the great depression?

- October 24, 1929:The stock market begins to decline sharply.

- October 28, 1929:The market falls even further, and panic begins to set in.

- October 29, 1929:The Black Tuesday Crash occurs. The Dow Jones Industrial Average falls by 12%, its largest one-day percentage decline in history.

Causes of the Black Tuesday Crash

The Black Tuesday Crash, which occurred on October 29, 1929, was the culmination of a series of economic factors that had been building for years. These factors included speculation and overconfidence in the stock market, the Federal Reserve’s policies, and the overall economic climate.

Speculation and Overconfidence

In the years leading up to the crash, there was a great deal of speculation and overconfidence in the stock market. Investors were buying stocks on margin, which meant they were borrowing money to invest in the market. This led to artificially inflated stock prices and created a bubble that was bound to burst.

Federal Reserve’s Policies

The Federal Reserve’s policies also contributed to the Black Tuesday Crash. In the years leading up to the crash, the Fed raised interest rates in an attempt to curb speculation. However, this only served to make it more expensive for businesses to borrow money and invest, which slowed down economic growth.

Economic Climate

The overall economic climate also played a role in the Black Tuesday Crash. The global economy was slowing down in the late 1920s, and this led to a decline in demand for American goods. This, in turn, led to a decline in corporate profits and a rise in unemployment.

Consequences of the Black Tuesday Crash: What Is The Nickname Of The Market Crash That Triggered The Great Depression?

The Black Tuesday Crash had immediate and far-reaching consequences that contributed to the onset of the Great Depression. The immediate impact on the stock market was devastating, with the Dow Jones Industrial Average plummeting by 12% in a single day, the largest one-day percentage decline in its history.

This triggered a chain reaction, as investors lost confidence in the market and began to sell their stocks, leading to a further decline in prices.

Chain Reaction to the Great Depression

The Black Tuesday Crash not only caused a loss of wealth for investors but also eroded public trust in the financial system. This led to a decrease in consumer spending and investment, which in turn led to a decline in economic activity.

The decline in economic activity led to widespread unemployment, poverty, and homelessness.

Long-Term Economic and Social Consequences

The long-term economic and social consequences of the Black Tuesday Crash were profound. The Great Depression lasted for over a decade and left a lasting scar on the global economy. It led to the rise of authoritarian regimes in Europe and Asia and contributed to the outbreak of World War II.

Lessons Learned from the Black Tuesday Crash

The Black Tuesday Crash of 1929 remains one of the most significant financial events in history, leading to the Great Depression. It holds valuable lessons for investors, policymakers, and regulators, emphasizing the importance of regulation, oversight, and the development of modern economic policies.

Importance of Regulation and Oversight

The Black Tuesday Crash exposed the dangers of an unregulated financial system. The lack of oversight and transparency allowed excessive speculation and risk-taking, contributing to the market bubble that eventually burst. This lesson led to the establishment of regulatory bodies like the Securities and Exchange Commission (SEC) to monitor and enforce rules in the financial markets.

Influence on Modern Economic Policies

The Great Depression, triggered by the Black Tuesday Crash, had a profound impact on economic thinking. It challenged the prevailing belief in laissez-faire capitalism and led to the development of Keynesian economics. Keynesian policies, which emphasize government intervention in the economy to stimulate demand and prevent economic downturns, became widely adopted during the Great Depression and continue to influence economic policymaking today.

Closing Notes

The lessons learned from the Black Tuesday Crash continue to resonate today. It highlighted the importance of prudent regulation, investor education, and the need for a robust financial system. The legacy of this event serves as a cautionary tale, reminding us of the fragility of markets and the devastating consequences that can arise from unchecked speculation.