Best Money Transfer and Payment Apps 2024 unveils the latest advancements in the digital finance landscape, guiding users through the complexities of seamless global transactions. This comprehensive guide explores the top-rated apps, their unique features, and the strategies for selecting the perfect fit for every financial need.

As the world embraces digitalization, money transfer and payment apps have emerged as indispensable tools, enabling individuals and businesses to transcend geographical barriers and conduct financial transactions with unprecedented ease and efficiency. This guide delves into the intricate details of these innovative solutions, empowering readers to navigate the ever-evolving financial ecosystem.

Comparison of Key Features

When choosing a money transfer or payment app, it’s essential to compare their key features to find the best fit for your needs. These features include transfer speed, fees and exchange rates, security measures, and customer support.

Transfer speed is a crucial factor, especially for urgent transfers. Some apps offer instant or same-day transfers, while others may take several days. Fees and exchange rates can also vary significantly, so it’s important to compare these costs before making a decision.

Best Money Transfer and Payment Apps 2024 provide convenient and secure ways to manage your finances. If you’re looking for additional ways to supplement your income, consider exploring Real Money Making Apps: A Guide to Earning and Monetizing. These apps offer various opportunities to earn money online, from completing surveys to playing games.

Once you’ve earned some extra cash, you can easily transfer it back to your bank account using one of the best money transfer and payment apps.

Security Measures

Security is paramount when dealing with financial transactions. Look for apps that employ robust security measures, such as encryption, fraud detection systems, and two-factor authentication. These measures protect your personal and financial information from unauthorized access.

For seamless money management, explore the Best Money Transfer and Payment Apps 2024. These innovative platforms empower you to transact effortlessly. To enhance your productivity, consider integrating The 10 best bots for Google Chat into your workflow. These bots streamline communication, automate tasks, and elevate your overall efficiency.

By leveraging both cutting-edge money management apps and productivity-boosting bots, you can optimize your financial and operational processes.

Customer Support, Best Money Transfer and Payment Apps 2024

Reliable customer support is essential for resolving any issues or inquiries you may have. Consider apps that offer 24/7 support through multiple channels, such as phone, email, or live chat. Responsive and knowledgeable support can provide peace of mind and ensure a smooth user experience.

Best Apps for Different Use Cases

Various money transfer and payment apps excel in specific use cases. Understanding these strengths allows users to choose the optimal app for their needs.

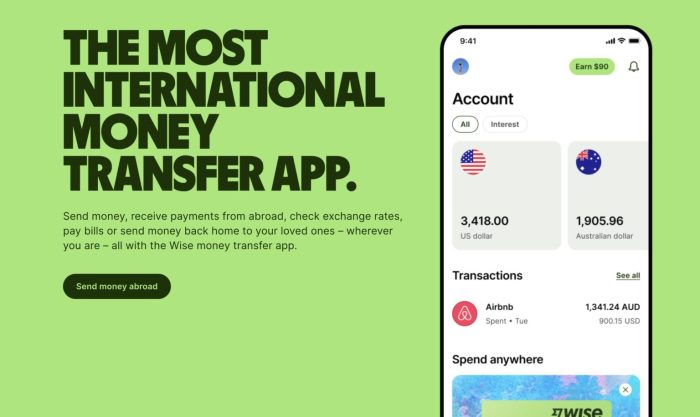

Sending Money Internationally

International money transfers can be expensive and time-consuming. However, certain apps offer competitive rates and fast processing times:

- Wise: Known for its low transfer fees and real-time exchange rates.

- Remitly: Fast and reliable transfers, with a wide reach of recipient countries.

- PayPal: Established and widely accepted, offering convenient international transfers.

Paying Bills Online

Paying bills online streamlines financial management and saves time. These apps simplify the process:

- Venmo: Enables easy bill splitting and rent payments among friends.

- Zelle: Instant and secure bill payments between bank accounts.

- Cash App: Offers direct deposits and bill pay features.

Making Purchases In-Store

Contactless payments are becoming increasingly popular. These apps provide convenient and secure in-store transactions:

- Apple Pay: Integrated with Apple devices, allowing for quick and easy payments.

- Google Pay: Similar to Apple Pay, offering a seamless payment experience on Android devices.

- Samsung Pay: Samsung’s mobile payment solution, supporting various payment methods.

Receiving Payments from Clients

Receiving payments from clients can be crucial for businesses. These apps facilitate efficient and secure transactions:

- Stripe: A comprehensive payment gateway with advanced features for businesses.

- PayPal Business: A widely used platform offering secure and flexible payment options.

- Square: Ideal for small businesses, providing POS systems and payment processing.

Emerging Trends in Money Transfer and Payments

The money transfer and payments industry is constantly evolving, with new technologies and trends emerging all the time. Some of the most notable trends include:

The rise of mobile payments:Mobile payments are becoming increasingly popular, as they are convenient, secure, and easy to use. In 2023, mobile payments are expected to account for over 50% of all non-cash transactions.

The use of blockchain technology:Blockchain technology is a distributed ledger system that is used to record transactions. It is secure, transparent, and efficient, making it ideal for use in money transfer and payments. Blockchain technology is expected to play a major role in the future of the money transfer and payments industry.

The adoption of digital currencies:Digital currencies, such as Bitcoin and Ethereum, are becoming increasingly popular. They are decentralized, meaning that they are not controlled by any central authority. Digital currencies are also global, meaning that they can be used to send and receive money anywhere in the world.

Impact of Emerging Trends

These emerging trends are having a significant impact on the money transfer and payments industry. They are making it easier, faster, and cheaper to send and receive money. They are also making the industry more secure and transparent.

As these trends continue to develop, they are expected to have an even greater impact on the money transfer and payments industry. They are likely to make it even easier, faster, and cheaper to send and receive money. They are also likely to make the industry even more secure and transparent.

Tips for Choosing the Right App: Best Money Transfer And Payment Apps 2024

When selecting the optimal money transfer and payment app, it’s crucial to evaluate various aspects to ensure alignment with your specific requirements. These factors include:

Fees and Exchange Rates

Scrutinize the fees and exchange rates imposed by different apps to avoid exorbitant charges that can diminish the value of your transfers. Consider both upfront fees and hidden costs, such as exchange rate markups.

Security Measures

Prioritize apps that implement robust security measures to safeguard your financial information and transactions. Look for features like two-factor authentication, encryption, and fraud detection systems.

Customer Support, Best Money Transfer and Payment Apps 2024

Ensure the app offers reliable and responsive customer support channels. This is particularly important in case of any issues or queries related to your transfers.

Supported Countries and Currencies

Verify that the app supports transfers to the countries and currencies you require. This is especially important if you frequently send money internationally.

Ending Remarks

In conclusion, Best Money Transfer and Payment Apps 2024 provides an invaluable roadmap for navigating the dynamic world of digital finance. By understanding the key features, comparing different apps, and leveraging expert tips, users can unlock the full potential of these transformative technologies.

As the financial landscape continues to evolve, this guide will serve as a trusted resource, empowering individuals and businesses to embrace the future of seamless global transactions.